Recent Blog

Category

Insurance

**🚨Are online platforms good enough to buy health insurance?**

Consulted a online platform (backed by a leading broker) for buying health insurance as I was having some free time yesterday morning.

On the call I asked them:-

Have my father who is 65 years of age with Diabeties and Hypertension, Which policy will you offer?

They told me they would suggest: HDFC Ergo Optima Secure or Star Health Senior

The person whom I talked to, did not understand my questions in depth as there wasn't any personal connect.

He told me Star is one of the best insurers

When I asked them about the Co-pay / Claims ratio etc. for Star Health and a lot of complaints on social media about the insurer? Agent tried to cook up some unwarranted explanations.

So he suggested to buy HDFC Ergo Optima Secure.

But when I told him the policy doesn't offer day 1 cover for diabetes and hypertension.

So, he said then buy Star Health Senior.

When I asked him about the policy from Care, Manipal Cigna, ICICI, Niva or Aditya Birla, the person did not have in-depth knowledge most any of their policies, In fact I educated him on various other policies.

Health insurance is superbly complex and very few understand the nitty-gritty properly.

You must have an agent who supports you and understands the terms and conditions in depth and provides you the product basis your needs and his/her needs.

Big platforms spend huge money on advertising and social media marketing, but very few of them are unbiased and provide very good advice. They sell what they have been basis their Sales Targets.

*Be very careful while buying policy online and understand the product well to avoid any regret in future. They wouldn't stand with you in case of any claim.

*

In case you still have any doubts, please feel free to reachout to us.

**Regards,

GYC by Dinesh Aneja**

Read More →

Category

Insurance

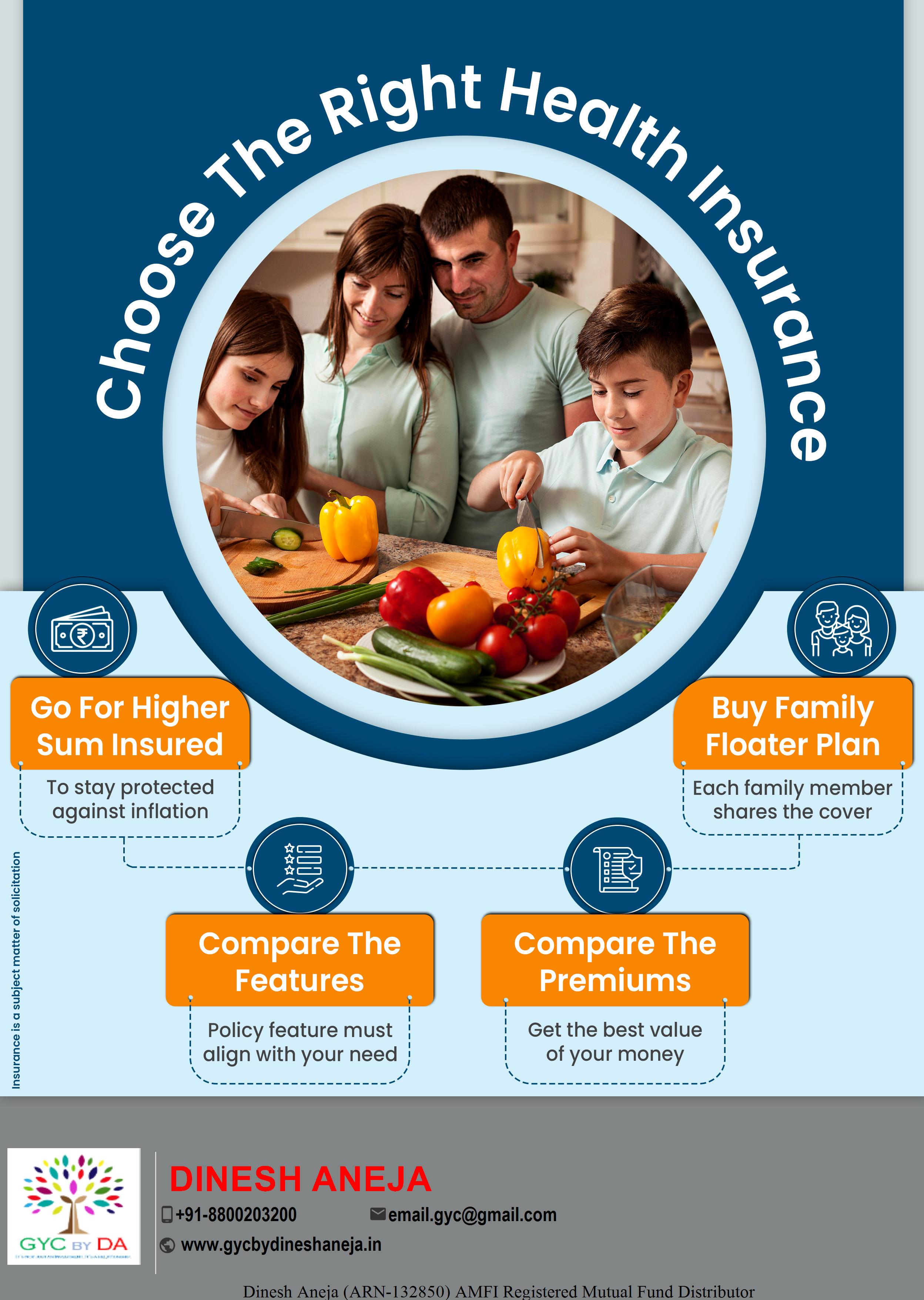

**Yes. You should definitely buy a health insurance policy at a younger age. Take a look at some of the reasons why buying health insurance at a younger age is a great idea:**

**1. Lower Premiums:** Your age is one of the most important factors that determine your health insurance premium. Insurance companies consider younger people healthier and so, are a lower liability for them. On the contrary, older people are more vulnerable to ailments and thus, are a greater liability to the insurance provider. As a result, the lower is your age, the lower will be your premium amount..

**2. Easier to Get Over Waiting Period:** Every health insurance policy comes with an initial waiting period of 30 days. Younger people are less likely to raise a claim during this period as their probability of having any serious medical condition is very low. Therefore, they can wait out the initial waiting period with ease. The same cannot be said for elderly people as they may face a medical emergency within days of buying the policy but will be unable to raise a claim during the waiting period.

**3. Seek Professional Guidance:** If you're unsure about where to start, it's highly recommended to seek professional guidance. An expert can assess your financial situation, health status including cover, and suggest suitable product thus reducing costly mistakes of claims denial etc.

**4. Financial Freedom:** The basic purpose of health insurance is to pay your medical expenses. With a health policy, you end up saving a lot of money on medical expenditures, especially those arising due to a sedentary lifestyle. Otherwise, you would have to pay for these expenses from your own pocket. Thus, the sooner you buy the policy, the more financial freedom you can enjoy.

**5. Never Depend on Employer Cover:** The moment your employment ends, the policy will get terminated. You will be out of insurance cover, till you get employed somewhere else. Not all the employer health insurance plans offer coverage to your dependent family members. It is one of the major shortcomings of this plan corporate plans. Hence, cover yourself and family with additional cover of your choice.

**6. Strictly Not An Investment for Returns:** Unlike investments, insurance premiums do not generate any returns or profits. The primary purpose of the premium is to transfer the risk from the policyholder to the insurance company. In other words, insurance premiums are a form of risk management, not a form of investment.

**7. Protect Your Loved Ones:** When you are looking for a suitable health insurance plan, the needs of your family are the top-most priority. Given the importance of health insurance for meeting medical expenses, it is more significant for people with financially dependent family members. The burden on a single income source for multiple people's healthcare is unimaginable.

It is essential to assess your situation carefully and invest in a plan that gives you optimum benefits. For example, if you have aging parents, they are more vulnerable to diseases and require efficient healthcare. You must calculate the need for health insurance earlier in life to prepare beforehand and have adequate financial support.

The right time to buy a health insurance policy is as soon as possible. The sooner you buy, the better it is for your pockets. Make sure to compare different health insurance plans online on Policybazaar.com to choose the best policy within your budget.

Please do call us on +91 8800203200 to get expert opinion.

Read More →